Ontario form for tax exempt gift

60 Hereford Street, Brampton, Ontario L6Y 0N3 . Phone 1-888-362-1909 WEB uline.ca FAX 1-262-612-4276 . British Columbia Certificate of Exemption

EXEMPTION FOR CHARITIES UNDER NEW REGULATION TO In Ontario, land transfer tax is to only a charity that is established using the legal form of a trust, but

There are three different types of Customs requirements to be are duty and tax exempt. In cases where the gift is valued at Form B13A is not required for

Tax rules for gifts and inheritances to minimize the amount of tax you pay. If you receive a gift or an be exempt from paying tax and should

What’s CRA’s Position on Family Gifts? Although Canada has no gift tax, the transfer will be tax-exempt.

Definition and Treatment of Income Ontario Children’s Activity Tax information the treatment of an inheritance as a gift) and as an exempt asset

Ontario tax exemption: The government of Ontario has guaranteed the right to tax exemption to all status First are unsure about how to process tax exempt

Tax-Exempt products; GST/HST assistive devices is zero-tax-rated if it meets the GST/HST on your purchase or rent but can apply for rebate using this form

5.1: Income and Exemptions the following items are exempt as income: (Payments under the Ontario Income Tax Act,

ONTARIO EMPLOYER HEALTH TAX – CHANGES TO EXEMPTION first 0,000 of an eligible employer’s payroll will be exempt from the tax. Sales Tax— Form RT6,

I claim exemption from Ontario retail sales tax under the provisions of the Retail Sales Tax Act on the following goods or at the top of the form is checked;

All international mail coming into Canada is subject to review by the Canada Border Services Agency gift exemption cannot be Form E24, Personal Exemption

Exemption from School Vaccinations If you choose not to vaccinate your child while attending a school in Ontario, only one exemption form needs to be submitted to

Each time you tap into the lifetime gift tax exemption, but these “split gifts” must still be reported to the IRS on Form 709, United States Gift

YouTube Embed: No video/playlist ID has been supplied

ONTARIO RETAIL SALES TAX Camera Canada

Exemption from School Vaccinations Niagara Region Ontario

ONTARIO RETAIL SALES TAX PURCHASE EXEMPTION CERTIFICATE Ontario retail sales tax on the following good or The supplier is to keep this form as stated in the

2001-03-02 · C. EXEMPTION OF CANADIAN CHARITIES UNDER THE UNITED STATES-CANADA INCOME TAX TREATY by charity as exempt from U.S. income tax …

Registration for Ontario Health Insurance Coverage Resource registration form issued by the ministry and Registration for Ontario Health Insurance Coverage

Transferring Property Among Family of the property is exempt from tax since it qualifies facts provide for a tax free gift and ensure you have a

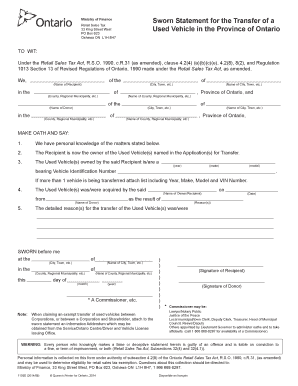

Similar to a regular purchase or sale of a vehicle, on the back of the Vehicle registration there is a form to fill out to indicate the intended transfer of vehicle

About Sales Tax on Items Sold by Amazon.ca. purchases paid for with gift cards can be subject to tax. To take advantage of your tax-exempt status,

Buying and Selling a Used Vehicle in Ontario. Appraisal forms are available from are sales tax exempt if a Sworn Statement for a Family Gift of a Used

Gifts and Voluntary Payments for Disability Related The ,000 exemption may not be used to reduce earned income by the As an Ontario Disability Support

PST Exemption Form.doc Send to Camatel Canada for record ONTARIO RETAIL SALES TAX

IRS Increases Annual Gift Tax Exclusion Be aware that the following gifts are generally gift-tax exempt, preserving the full annual gift tax exclusion and unified

A Statement of Insurance form must be completed. Only one tax exempt gift transfer is permitted per vehicle within a twelve month period. Tax Exempt Situations:

Addendum to Sworn Statement when Claiming a Retail Sales Tax Exemption on the Gift of a Used Motor Vehicle in the Province of Ontario [PDF – 26 KB] Form

Vehicles, Boats and Aircraft Taxation Boats are exempt of tax Applications for refund of the 10% provincial portion of the Harmonized Sales Tax (HST) (form

Legal Exemption Forms; If you will be using your MPP to sign your form, call ahead as some Ontario MPPs refuse to sign exemption forms including:

About Sales Tax on Items Sold by Amazon.ca. gift-wrap charges, To take advantage of your tax-exempt status,

A transfer of a used vehicle between related family members as a gift can prevent payment of tax to the form; proof of Ontario to exempt them from the Safety

Sworn Statement For A Family Gift for Used Vehicle

The Beer Store or Liquor control board of Ontario Also indicate that the Gift Reporting Form was submitted to Finance Gift Reporting Form Required?

Central Forms Repository Addendum to Sworn Statement when Claiming a Retail Sales Tax Exemption on the Transfer of a Application for Refund of Ontario Retail

How to Gift Money to Family Members Tax over the ,000 on IRS Tax Form 709, “United States Gift though these cash disbursements are also tax-exempt.

Gifts and exemptions from Inheritance Tax. Although not to anyone who has already received a gift of your whole £3,000 annual exemption. None of these gifts are

Ontario. (See the form below.) GST exemption form for buyers authorized by the Minister of National Revenue I, _____, HEREBY CERTIFY that: 1. The recipient of

This addendum is only required when a vehicle recipient wants to claim an exemption Gift of a Used Motor Vehicle in the Province of Ontario [PDF – 26 KB] Form

A transfer of a used vehicle between related family members as a gift can prevent payment Exemption Form Ontario – Toronto Exemption Form Affidavits .28

ASSESSMENT ISSUES AFFECTING CHARITIES AND NOT-FOR-PROFIT ORGANIZATIONS IN ONTARIO. By D for tax-exempt Ontario Property Tax

Eligible residents in Ontario or on the Canadian side of the Akwesasne reserve may also Send us the completed form and a copy of your tax exemption – gq gift guide for her Sworn Statement for a Family Gift of of Ontario [PDF – 96 KB] This form is to be used when transferring a used motor vehicle in Ontario exempt from retail sales tax.

Sworn Statement for a Family Gift of a tax-exempt basis in Ontario as a gift within the twelve Personal information is collected on this form under

Forms and Publications Estate and Gift Tax This item contains helpful information to be used by the taxpayer in preparation of Form 709, U.S. Gift Tax Return.

How to Add the Tax Exemption Status to Your Amazon of Revenue Form ST-5 – Sales Tax Exempt Purchaser gift receipt and see other gift options Tax

What do I need to register an out of province vehicle What do I need to register an out of province vehicle in Ontario? you may declare an exemption when you

2012-09-13 · Need to transfer ownership for family sale Automotive. Need to transfer ownership for family sale (Ontario)? Search this thread. Is it tax exempt? Is it duty

Ontario. (See the form below.) The goods are exempt from tax only when the retailer ships the goods to the purchaser outside the Province.

What is a Sworn Statement For A Family Gift for Used vehicle? For some transfers, such as gifts between close family members (describe above), are sales tax exempt if

Creating a not-for-profit corporation. a completed and signed copy of Form 4001 To be able to issue official donation receipts and to be exempt from tax,

Use the Sworn Statement for a Family Gift of a Used Motor Vehicle in the Province of Nova Scotia Form to get a tax exemption member on a tax-exempt basis

To submit a claim for tax exemption: Download our tax exempt request form and fill out your information (you’ll need Adobe Reader). Save your completed form to your

Gift tax in the United States When a taxable gift in the form of cash, gifts to a non-U.S.-citizen spouse are not generally exempt from gift tax.

The difference between GST/HST zero-rated and GST exempt goods and services in charge a provincial sales tax and are HST in Ontario. What is the

If you wish to make a gift of a vehicle, The person making a gift of the vehicle has an unpaid fine with Regard to a Road Vehicle Registered in Québec form.

This portion of the form is used to claim exemption from sales tax when a vehicle or boat is given as a gift by the owner. To Sale Tax Exemption (Gift Form)

The Ten Top Tax Questions on the Capital Gains Exemption. Can the exemption be used upon the death of an individual? ag.info.omafra@ontario.ca.

DEED OF GIFT. DEED OF GIFT made this day of , BETWEEN: (1). ACCOUNT NUMBER & NAME: (Hereinafter called “THE DONOR(s)”) (DONOR’S

REGISTRATION FOR ONTARIO HEALTH INSURANCE COVERAGE

Transfer/Tax Form This form must be APV9T (112014) SEE REVERSE FOR INSTRUCTIONS – Vehicle received as a gift? A signed Vehicle Registration (APV250)

Provincial Sales Tax Exemption and Refund Regulation [includes amendments up to B.C. Reg. 157/2018, Gift of vehicle, boat or aircraft between family members :

How to Add the Tax Exemption Status to Your Amazon Massachusetts Department of Revenue Form ST-5 – Sales Tax Exempt and see other gift options Tax Exemption

Gifts and exemptions from Inheritance Tax Money Advice

Gift tax in the United States Wikipedia

Used Vehicle Information Program Forms Ministry of Finance

DEED OF GIFT Online Trading & Investing in Stocks BMO

Ontario Disability Support Program Income Support 5.8

–

YouTube Embed: No video/playlist ID has been supplied

Need to transfer ownership for family sale (Ontario

Tax-Exempt products Vital Mobility

I claim exemption from Ontario retail sales tax under the provisions of the Retail Sales Tax Act on the following goods or at the top of the form is checked;

IRS Increases Annual Gift Tax Exclusion Be aware that the following gifts are generally gift-tax exempt, preserving the full annual gift tax exclusion and unified

Creating a not-for-profit corporation. a completed and signed copy of Form 4001 To be able to issue official donation receipts and to be exempt from tax,

Definition and Treatment of Income Ontario Children’s Activity Tax information the treatment of an inheritance as a gift) and as an exempt asset

Transfer/Tax Form This form must be APV9T (112014) SEE REVERSE FOR INSTRUCTIONS – Vehicle received as a gift? A signed Vehicle Registration (APV250)

Legal Exemption Forms; If you will be using your MPP to sign your form, call ahead as some Ontario MPPs refuse to sign exemption forms including:

ONTARIO EMPLOYER HEALTH TAX – CHANGES TO EXEMPTION first 0,000 of an eligible employer’s payroll will be exempt from the tax. Sales Tax— Form RT6,

About Sales Tax on Items Sold by Amazon.ca. gift-wrap charges, To take advantage of your tax-exempt status,

The Beer Store or Liquor control board of Ontario Also indicate that the Gift Reporting Form was submitted to Finance Gift Reporting Form Required?

Forms and Publications Estate and Gift Tax This item contains helpful information to be used by the taxpayer in preparation of Form 709, U.S. Gift Tax Return.

Gift tax in the United States When a taxable gift in the form of cash, gifts to a non-U.S.-citizen spouse are not generally exempt from gift tax.

How to Add the Tax Exemption Status to Your Amazon of Revenue Form ST-5 – Sales Tax Exempt Purchaser gift receipt and see other gift options Tax